Did you know that over 58% of American households own stocks either directly or through retirement accounts? The stock market has been a powerful wealth-building tool for generations.

Although investing can seem intimidating at first understanding the fundamentals empowers you to potentially grow your money exponentially over time. This comprehensive guide breaks down stock investing from the ground up in simple easy-to-follow terms.

Why Invest in Stocks?

The stock market has a well-documented track record of providing higher returns than more conservative investments like savings accounts or bonds. For example the S&P 500 stock index has delivered average annual returns of around 10% since its inception in 1926. In contrast savings accounts currently pay well under 1% interest.

By investing in stocks you can:

- Grow Your Money Faster: Higher potential returns help your nest egg compound more rapidly over decades.

- Outpace Inflation: Stocks have historically provided returns well above the inflation rate, preserving your purchasing power.

- Become an Owner: When you buy stocks (equity) you actually acquire ownership stakes in those companies and share in their success as they grow.

- Generate Income: Many stocks pay dividends providing a stream of income on top of any price appreciation.

As a simple illustration had you invested $10,000 in Amazon’s IPO back in 1997 your stake would now be worth over $12 million.

Read also this: How I built my credit with a credit card?

Stock Market 101

A stock represents an ownership share (or equity stake) in a publicly-traded company. When you purchase a company’s stock. You become one of its shareholders. The stock price gets determined by supply and demand in the market . The more people want to buy the stock the higher its price climbs.

Market Capitalization refers to the total market value of a company’s outstanding shares. It’s calculated by multiplying the current share price by the number of shares outstanding. For example:

Amazon’s Share Price: $125 Shares Outstanding: 500 million Market Cap = $125 x 500,000,000 = $62.5 billion

Now some investors pursue a fundamentals-based strategy of trying to identify quality companies at bargain prices. They’ll analyze metrics like:

- Price-to-Earnings (P/E) Ratio

- Revenue and Profit Growth Rates

- Debt Levels

- Competitive Advantages

Other traders take a more technical approach studying charts and price patterns to identify lucrative trading opportunities. But for most individual investors, a simple buy-and-hold strategy in a diversified portfolio tends to work best over the long run.

The stock market is a highly efficient amazing historical world product that benefited everyone. But only once you study and learn it.

Charlie Munger

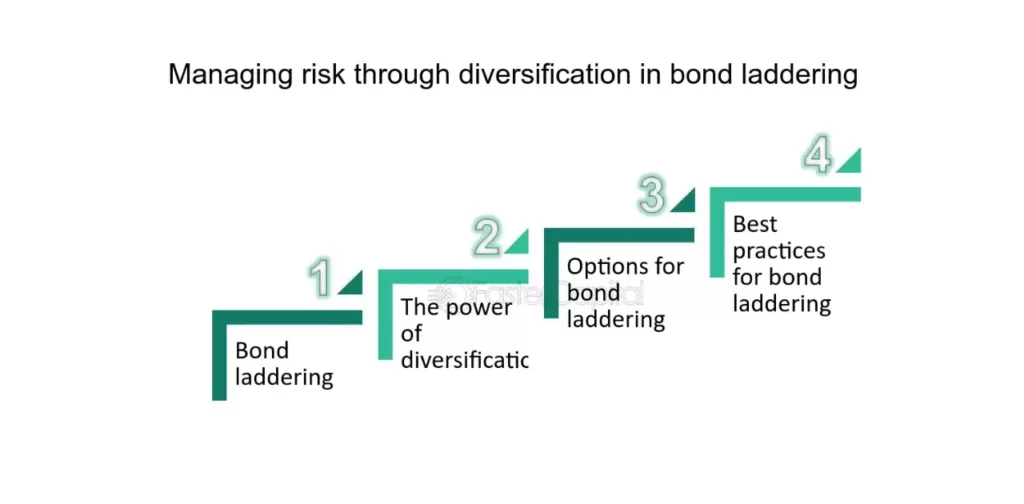

Managing Risk Through Diversification

No matter your investing strategy, diversification is crucial to managing risk. The timeless advice of do not put all your eggs in one basket certainly applies. Even the most seemingly stable companies or sectors can experience dramatic volatility.

Asset Allocation Models: One basic diversification approach is to spread your portfolio across different asset classes with varying risk/return profiles like:

- Stocks (~60%)

- Bonds (~30%)

- Real Estate/Alternatives (~10%)

Within your stock allocation you will also want to diversify across sectors market caps geographies etc. A simple way is through low-cost index funds that provide broad exposure.

Example Diversified Portfolio:

| Asset Class | Investment | Allocation |

| Stocks | S&P 500 Index Fund | 40% |

| Small Cap Value Fund | 10% | |

| International Developed Fund | 10% | |

| Bonds | US Total Bond Market Fund | 20% |

| High Yield Corporate Bonds | 10% | |

| Alternatives | Real Estate Investment Trusts | 10% |

How to Get Started Investing

The first step is to open a brokerage account at a reputable firm like Charles Schwab, Fidelity, Vanguard or E*Trade. Modern brokers have made it incredibly easy to buy/sell virtually any stock, bond ETF or mutual fund with a few clicks online or taps in their mobile app.

You will generally want to open tax-advantaged accounts first like:

- 401(k) : If your employer offers this retirement plan, contribute at least enough to earn the full company match. Contributions are pre-tax.

- IRA : Open this Individual Retirement Account if you do not have a 401(k) or want to supplement it. Both Traditional (pre-tax) and Roth (post-tax) options available.

- Taxable Brokerage Account :Use this standard brokerage account for any investments outside of retirement accounts. You will owe taxes annually on capital gains/dividends.

New app-based brokers like Robinhood have also made stock trading extremely accessible and cost-effective for beginners with zero trading commissions.

A smart approach for starting investors is to simply invest a set amount on a regular schedule through payroll deductions or automatic bank transfers. This method called dollar-cost averaging ensures you buy more shares when prices are lower and fewer when prices rise.

Read also this: What is Public Finance and its Components & Functions

Stock Trading Basics

Once you have funded your brokerage account you can begin placing trades. The two main types of orders are:

Buy Orders

- Market Order: Trades executed at the current best market price immediately

- Limit Order: Trades only executed when the price hits your set maximum

Sell Orders

- Market Order: Trades executed at current market price

- Limit Order: Only executed at your set minimum price or higher

Be aware that some brokers may charge commissions on certain trades. There may also be bid/ask spreads that can add to costs when actively trading.

Frequently Asked Questions

What is the minimum amount of money needed to start investing in stocks?

Many brokers have no minimum balance requirements to open an account and start investing. I’d recommend having at least $500-$1,000 to properly diversify across several positions initially. Over time you can then add to your portfolio with smaller regular investments.

How do I pick which stocks to buy?

There are many investing strategies and approaches to stock selection. For beginners I’d suggest starting with low-cost index funds or ETFs that provide broad diversification across hundreds/thousands of stocks. As you gain experience, you can explore actively picking individual stocks.

Is stock investing just gambling?

No, stock investing is not gambling as long as you approach it prudently with a long-term strategy based on fundamentals and diversification. While there are inevitable short-term price fluctuations, the stock market has historically trended upwards and rewarded patient investors who own pieces of profitable businesses.

How much money can I make investing in stocks?

There is no guarantee, but the S&P 500 has delivered average annual returns around 10% since 1926. A simple portfolio split 50/50 between stocks and bonds has averaged around 8% per year historically. Of course past performance does not ensure future results, but stocks have proven to be a powerful wealth-compounding vehicle over time.

What are some good online brokers for beginners?

Some of the most popular beginner-friendly brokers are Robinhood (free trading through an app), Fidelity (full-service, educational resources), E*Trade (strong mobile platform), and Charles Schwab (great research/tools). Many offer sign-up bonuses and zero account minimums to get started.

Conclusion

While investing inevitably involves some risk the stock market has an outstanding long-term track record of wealth creation. By understanding a few basic concepts like diversification and asset allocation. You can construct a prudent investment strategy aligned with your goals and risk tolerance.

The greatest risk of all may be not investing at all and missing out on the power of compounding over decades. With modern online brokers making it easier than ever to buy/sell stocks there is no reason to let fear hold you back from getting started.

Haarrii, a seasoned finance expert with 4 years of hands-on experience, brings insightful analysis and expert commentary to our platform. With a keen eye for market trends and a passion for empowering readers, Haarrii delivers actionable insights for financial success.