Are you tired of the rollercoaster ride that comes with short-term trading? Imagine turning $10,000 into $1,000,000 – it’s not just a pipe dream. Welcome to the world of long-term stocks investing, where patience isn’t just a virtue.

It is your ticket to financial freedom. In this deep dive, we will explore why holding stocks for the long haul can be your secret weapon for building lasting wealth.

What Defines “Long-Term” in Stock Investing?

Before we jump into the benefits, let’s set the stage. When we talk about long-term investing, we’re not talking about next week or even next year. We’re thinking in terms of decades.

- 5 years: The minimum threshold for most long-term strategies

- 10 years: Where the real magic starts to happen

- 20+ years: The sweet spot for truly life-changing returns

Warren Buffett, the Oracle of Omaha himself, famously quipped that his favorite holding period is “forever.” While that might be a bit extreme for most of us, it highlights a crucial point: the longer you hold quality stocks, the more likely you are to see substantial gains.

The Magic of Compound Interest

At the heart of long-term investing is the power of compound interest. It’s what Einstein allegedly called the “eighth wonder of the world.” Here’s a quick example to illustrate:

Let’s say you invest $10,000 in a stock index fund that returns an average of 10% per year (roughly the historical average of the S&P 500). Here’s how your investment might grow:

| Years | Investment Value |

| 10 | $25,937 |

| 20 | $67,275 |

| 30 | $174,494 |

| 40 | $452,593 |

This table shows the staggering difference just a few extra years can make. By year 40, your initial $10,000 has turned into over $450,000 – and that’s without adding a single extra dollar!

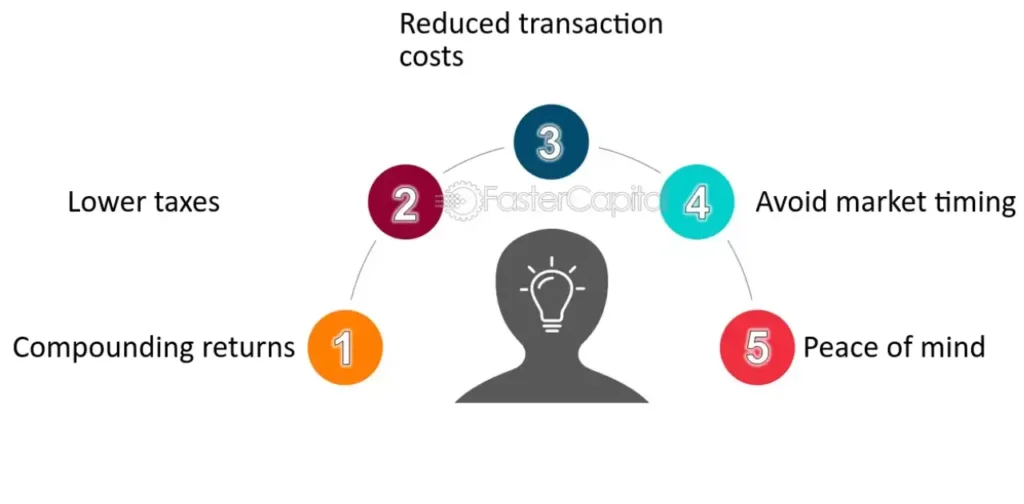

Top 5 Benefits of Long-Term Stock Holding

Riding Out Market Volatility

One of the biggest advantages of long-term investing is the ability to weather short-term market storms. Let’s look at a real-world example:

Case Study: 2008 Financial Crisis vs. 2020 Pandemic Recovery

During the 2008 financial crisis, the S&P 500 dropped by about 57% from its peak. Many panic-sold at the bottom, locking in massive losses. But those who held on? They saw the market not only recover but soar to new heights. Fast forward to 2020, and we saw a similar pattern during the COVID-19 crash. The market plummeted in March but rebounded strongly, rewarding patient investors.

The lesson? Short-term volatility is the price of admission for long-term gains.

Also read this: How to Get a Netflix Free Trial in 2024 With StellarFi Virtual Bill Card?

Harnessing the Power of Compound Returns

We touched on compound interest earlier, but it’s worth diving deeper. Compound returns are like a snowball rolling downhill – the longer it rolls, the bigger it gets, and the faster it grows.

Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.

Albert Einstein

This is especially powerful when you reinvest dividends. Instead of taking that cash, you’re buying more shares, which in turn generate more dividends. It’s a virtuous cycle that can significantly boost your returns over time.

Tax Advantages

Uncle Sam smiles on long-term investors. In the US, stocks held for more than a year qualify for long-term capital gains rates, which are significantly lower than short-term rates. As of 2024:

- Short-term capital gains: Taxed as ordinary income (up to 37%)

- Long-term capital gains: 0%, 15%, or 20%, depending on your income bracket

For high earners, this difference can mean keeping thousands more dollars in your pocket.

Lower Costs and Fees

Every time you trade, you’re potentially incurring costs:

- Transaction fees: While many brokers offer commission-free trading, there can still be other costs.

- Bid-ask spreads: The difference between the buying and selling price of a stock.

- Taxes: As mentioned, short-term trades are taxed at a higher rate.

These costs might seem small, but they add up over time and can significantly eat into your returns. By trading less frequently, you’re keeping more money invested and working for you.

Emotional Benefits

Last but not least, long-term investing can be good for your mental health. When you’re not glued to daily stock movements, you’re free to focus on what really matters in life. You’re building true wealth, not chasing the next hot stock tip.

Strategies for Successful Long-Term Stock Investing

Now that we have covered the why let’s talk about the how. Here are some tried-and-true strategies for long-term success:

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different sectors and even asset classes to reduce risk.

- Dollar-cost averaging: Instead of trying to time the market, invest a fixed amount regularly. This way, you buy more shares when prices are low and fewer when they’re high.

- Dividend reinvestment: If you own dividend-paying stocks, consider reinvesting those dividends automatically. It’s an easy way to compound your returns.

- Focus on quality: Look for companies with strong competitive advantages, solid financials, and good management. These are the stocks most likely to stand the test of time.

Read also this: The Impact of Poor Cash Flow Management on Your Business

Common Pitfalls to Avoid

Even with the best intentions, long-term investors can fall into traps. Here are some to watch out for:

- Panic selling during downturns: This is perhaps the biggest wealth destroyer. Remember, you haven’t lost money until you sell.

- Overtrading: Constantly buying and selling based on news or short-term price movements can lead to underperformance.

- Neglecting rebalancing: While you shouldn’t trade often, you should periodically review and adjust your portfolio to maintain your desired asset allocation.

- Falling for “hot” tips: The next big thing often isn’t. Stick to your long-term plan rather than chasing the latest fad.

Tools and Resources for Long-Term Investors

To succeed in long-term investing, arm yourself with the right tools:

- Brokerages: Look for platforms with low fees and good research tools. Vanguard, Fidelity, and Charles Schwab are popular choices for buy-and-hold investors.

- Stock screeners: Tools like Finviz or Yahoo Finance can help you find stocks that meet your criteria.

- Books: “The Intelligent Investor” by Benjamin Graham and “Common Stocks and Uncommon Profits” by Philip Fisher are classics for a reason.

- Podcasts: “Motley Fool Money” and “InvestED” offer great insights for long-term investors.

The Psychology of Patience: Training Your Investing Mind

Long-term investing isn’t just about strategy; it’s about mindset. Here are some tips to develop the patience needed for success:

- Set realistic expectations: The stock market doesn’t go up in a straight line. Expect volatility and prepare for it mentally.

- Focus on your goals, not daily prices: Keep your eye on the long-term prize, whether it’s retirement, a child’s education, or financial independence.

- Educate yourself: The more you understand about investing and market history, the less likely you are to make emotional decisions.

“The stock market is a device for transferring money from the impatient to the patient.”

Warren Buffett

Remember, building wealth is a marathon, not a sprint. Start your journey today, stay the course, and watch your financial future transform over time.

The Role of Dollar-Cost Averaging in Long-Term Investing

Dollar-cost averaging (DCA) is a powerful technique that complements long-term stock holding. Here’s how it works and why it’s beneficial:

- Consistent Investing: You invest a fixed amount regularly, regardless of market conditions.

- Averaging Out Costs: By buying more shares when prices are low and fewer when they’re high, you naturally average out your purchase price over time.

- Reducing Emotional Decisions: DCA takes the guesswork out of timing the market, helping you avoid emotional buying or selling.

Here’s a simple example to illustrate:

| Month | Investment | Share Price | Shares Purchased |

| 1 | $500 | $50 | 10 |

| 2 | $500 | $40 | 12.5 |

| 3 | $500 | $60 | 8.33 |

In this scenario, you’ve invested $1,500 total and acquired 30.83 shares. Your average cost per share is $48.65, which is lower than the average price of $50 over the three months.

The Impact of Dividends on Long-Term Returns

Dividends play a crucial role in long-term stock performance. Many investors underestimate their impact:

- Reinvested Dividends: When you reinvest dividends, you’re essentially practicing a form of dollar-cost averaging, buying more shares over time.

- Compounding Effect: Reinvested dividends can significantly boost your total returns over long periods.

- Income Stream: For retirees or those seeking passive income, dividends can provide a steady cash flow without selling shares.

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” – John D. Rockefeller

Case Study: S&P 500 Returns With and Without Dividends

Let’s look at the S&P 500’s performance from 1960 to 2020:

- Price appreciation only: 6.47% annualized return

- With dividends reinvested: 9.81% annualized return

This 3.34% difference might seem small, but over 60 years, it’s the difference between turning $10,000 into $427,000 versus $3,845,000!

The Importance of Sector Allocation in Long-Term Portfolios

While diversification is crucial, understanding and strategically allocating to different sectors can enhance your long-term returns:

- Cyclical Sectors: Like consumer discretionary and financials, tend to perform well during economic expansions.

- Defensive Sectors: Such as utilities and consumer staples, often outperform during recessions.

- Growth Sectors: Technology and healthcare have shown strong long-term growth potential.

- Value Sectors: Energy and materials can offer opportunities for patient investors.

A well-balanced portfolio might include exposure to all these sectors, adjusted based on your risk tolerance and market outlook.

The Long-Term Investor’s Toolkit: Essential Resources

To succeed in long-term investing, continuous learning is key. Here are some invaluable resources:

- Financial Statements: Learn to read annual reports (10-Ks) and quarterly reports (10-Qs).

- Investment Calculators: Use compound interest calculators to visualize long-term growth.

- Stock Screening Tools: Finviz, Yahoo Finance, and Morningstar offer free screeners.

- Investment Newsletters: Consider subscribing to reputable newsletters for insights and ideas.

- Educational Websites: Investopedia and Khan Academy offer free courses on investing basics.

The Psychology of Long-Term Investing: Overcoming Behavioral Biases

Understanding and overcoming psychological biases is crucial for long-term success:

- Loss Aversion: We feel losses more acutely than gains. Combat this by focusing on long-term goals rather than short-term fluctuations.

- Recency Bias: We tend to overweight recent events. Remember that market history is long, and patterns repeat.

- Confirmation Bias: We seek information that confirms our beliefs. Challenge your assumptions regularly.

- Anchoring: We fixate on specific numbers or ideas. Be flexible in your thinking and open to new information.

Building a Long-Term Investment Plan: A Step-by-Step Guide

- Define Your Goals: What are you investing for? Retirement, a home, education?

- Assess Your Risk Tolerance: Be honest about how much volatility you can handle.

- Determine Your Time Horizon: This will influence your asset allocation.

- Choose Your Asset Allocation: Decide on the mix of stocks, bonds, and other assets.

- Select Your Investments: Choose individual stocks, ETFs, or mutual funds that align with your strategy.

- Implement Dollar-Cost Averaging: Set up regular investments to smooth out market volatility.

- Rebalance Periodically: Review and adjust your portfolio annually or semi-annually.

- Stay Educated: Continuously learn about investing and stay informed about your holdings.

The Future of Long-Term Investing: Emerging Trends

As you embark on your long-term investing journey, keep an eye on these emerging trends:

- ESG Investing: Environmental, Social, and Governance factors are increasingly important.

- Artificial Intelligence: AI is changing how we analyze stocks and make investment decisions.

- Blockchain and Cryptocurrencies: While speculative, these technologies may play a role in future portfolios.

- Demographic Shifts: Aging populations in developed countries and growing middle classes in emerging markets will shape future investment opportunities.

Frequently Asked Questions

How long should I hold stocks for maximum benefit?

While there’s no one-size-fits-all answer, holding quality stocks for at least 5-10 years can help you ride out market volatility and benefit from compound growth. Many successful investors, like Warren Buffett, advocate for even longer holding periods of 20+ years or even “forever” for truly great companies.

What if I need the money before my long-term goal?

A: It’s important to align your investment timeline with your financial needs. For short-term goals (less than 5 years), consider more stable investments like high-yield savings accounts or short-term bonds. For mid-term goals, a mix of stocks and bonds might be appropriate. Long-term money that you won’t need for 10+ years can be more heavily invested in stocks.

Are there any downsides to holding stocks long-term?

While long-term holding has many benefits, there are potential drawbacks to consider:

- Opportunity cost: You might miss out on other investment opportunities.

- Company-specific risk: Even great companies can face challenges over long periods.

- Inflation risk: Your returns need to outpace inflation to maintain purchasing power.

- Lack of liquidity: Your money is tied up and not easily accessible.

These risks can be mitigated through diversification and periodic portfolio reviews.

How do I choose stocks for long-term holding?

Look for companies with:

- Strong competitive advantages or “moats”

- Consistent revenue and earnings growth

- Solid balance sheets with manageable debt

- Good management with a track record of smart capital allocation

- Attractive valuations relative to their growth prospects

Consider starting with broad index funds before moving into individual stock picking.

Can I apply long-term strategies to other investments besides stocks?

Absolutely! Long-term strategies can be applied to many types of investments:

- Real estate: Holding property for long periods can lead to significant appreciation and rental income.

- Bonds: Long-term bond holdings can provide steady income, especially in retirement portfolios.

- Index funds and ETFs: These offer diversification and can be excellent long-term holdings.

- Alternative investments: Some investors hold commodities, cryptocurrencies, or private equity for the long term, though these often come with higher risks.

The key is to understand the characteristics of each asset class and how they fit into your overall financial plan and risk tolerance.

Conclusion

Long-term stock holding is not just an investment strategy; it is a mindset. It requires patience, discipline, and a willingness to learn and adapt. By understanding the benefits, implementing sound strategies, and staying committed to your goals, you can harness the incredible wealth-building power of the stock market over time.

Remember, the journey of a thousand miles begins with a single step. Start your long-term investing journey today, stay the course through market ups and downs, and watch as compound interest works its magic on your financial future.

Haarrii, a seasoned finance expert with 4 years of hands-on experience, brings insightful analysis and expert commentary to our platform. With a keen eye for market trends and a passion for empowering readers, Haarrii delivers actionable insights for financial success.