Choosing a solar installer to finance involves selecting a company to install solar panels for your business while also providing financing options. It entails assessing the installer’s experience, certifications, and reputation, as well as exploring various financing models. Such as loans, leases, or power purchase agreements. The goal is to find a reliable installer that offers suitable financing options tailored to your needs, ensuring a smooth transition to solar energy while optimizing financial resources.

What is Solar Energy?

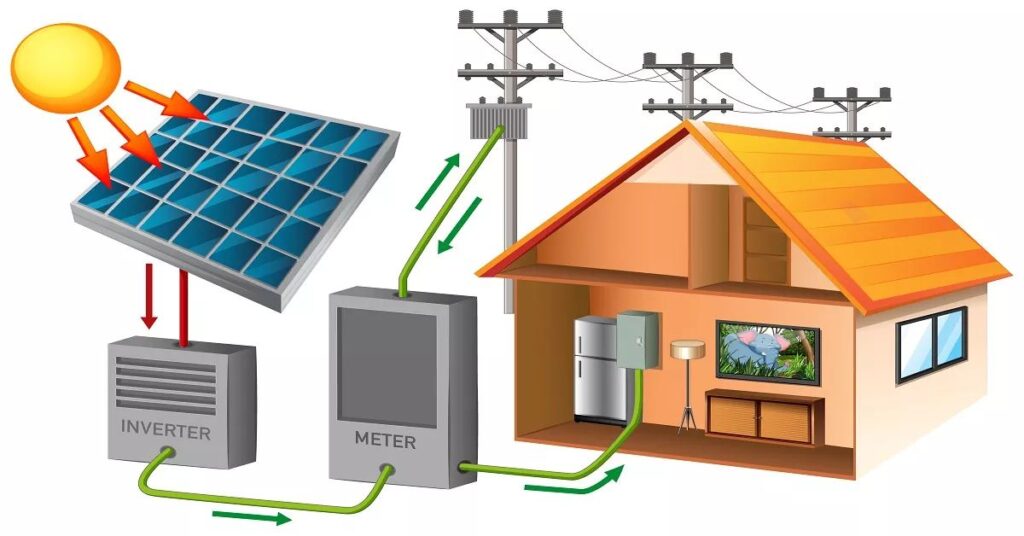

Solar energy is the radiant light and heat emitted by the sun. It’s a renewable and sustainable energy source harnessed through technologies like solar panels for electricity generation. Widely adopted for its environmental benefits and versatility in residential and commercial applications.

Importance of Choosing the Right Solar Installer

- The expertise and reliability of the chosen solar installer significantly impact the success of the solar energy project.

- A reputable installer not only ensures proper installation but also guides financing options and system maintenance.

- Choosing the right installer can lead to optimal performance, long-term savings, and a seamless transition to solar energy.

Types of Finance Available for Solar Installer

| Financing Option | Description |

| Cash Purchase | Outright ownership of the solar energy system, providing long-term savings and incentives. |

| Solar Loans | Financing is tailored to individual needs, allowing upfront payment with gradual repayment. |

| Power Purchase Agreements (PPAs) | Contract where the installer owns and maintains the system, with the client purchasing generated electricity at a fixed rate. |

| Solar Leases | Lease agreement where the solar equipment is leased from a provider, offering immediate savings with minimal upfront costs. |

| Property Assessed Clean Energy (PACE) Financing | Enables financing solar installations through property tax assessments, spreading the cost over time. |

Researching Solar Installers: What to Look For

When researching solar installers, consider the following key aspects:

- Experience and Expertise: Look for installers with a proven track record and expertise in solar installations, especially in projects similar to yours.

- Reviews and Testimonials: Check online reviews and testimonials from previous clients to gauge the installer’s reputation and quality of service.

- Licenses and Certifications: Ensure the installer holds necessary licenses and certifications, such as those from organizations like NABCEP, indicating their professionalism and adherence to industry standards.

- Financing Options: Explore the installer’s knowledge of various financing options available for solar projects, ensuring they can guide you through the most suitable options for your needs.

- Quality of Peripherals: Assess the quality of solar panels, inverters, and other system components offered by the installer, ensuring they meet high standards for performance and durability.

- Customer Service: Consider the installer’s level of customer support and after-sales service, including warranties and maintenance plans, to ensure ongoing satisfaction with your solar system.

Also Read: What companies are in the finance field?

Solar Installer to Finance: Exploring Financing Options

| Financing Option | Description |

| Purchase | Buying a solar energy system outright allows ownership and long-term savings on energy costs and incentives. |

| Lease | Renting a system involves paying a monthly fee to a solar company, providing immediate savings with little to no upfront costs. |

| Power Purchase Agreement | Under a PPA, the installer owns and maintains the system, while the customer purchases the generated electricity at a predetermined rate, offering consistent energy costs. |

| Solar Loans | Financing options tailored for solar projects, including loans with various terms and interest rates, enable customers to own the system while spreading out payments over time. |

| Property Assessed Clean Energy Financing | Allows property owners to finance renewable energy installations through property tax assessments, often with favorable terms and low-interest rates. |

| Green Energy Loans and Programs | Various financial institutions and government programs offer loans and incentives specifically for renewable energy projects, providing accessible financing for solar installations. |

Comparing Quotes and Proposals

When comparing quotes and proposals from different solar installers, consider the following factors:

- Cost: Compare the total cost of the installation, including equipment, labor, permits, and any additional fees.

- Equipment Quality: Assess the quality of the solar panels, inverters, and other components included in each proposal.

- Warranties: Review the warranties offered for both equipment and installation to ensure adequate coverage.

- Financing Terms: Evaluate the financing options available, including interest rates, repayment terms, and upfront costs.

- Timeline: Consider the projected timeline for installation and completion provided by each installer.

- Customer Reviews: Research customer reviews and testimonials to gauge satisfaction with past projects and customer service.

- Additional Services: Compare any additional services offered, such as maintenance packages or monitoring systems.

- Company Reputation: Consider the reputation and experience of each installer within the industry.

Finalizing Your Decision

When finalizing your decision, review the proposals carefully, ensuring all terms are clearly understood and agreed upon. Consider factors such as cost, equipment quality, warranties, and customer reviews to select the most suitable solar installer for your project. Once decided, sign the agreement confidently, knowing you’ve chosen the best option to meet your solar needs.

How To Choose a Solar Installer to Finance B2B?

When selecting a solar installer to finance B2B projects, thorough research is essential. Consider the installer’s experience, certifications, and customer feedback to ensure quality service. Explore financing options tailored to commercial projects, like solar loans or PPAs, to find the best fit for your business needs.

how do compare solar companies?

- Assess experience and expertise.

- Review customer feedback and ratings.

- Compare pricing and financing options.

- Evaluate warranties and post-installation support.

- Consider installation timelines and scheduling.

Also Read: Payday Loans Eloanwarehouse

solar panel financing

- Solar loans: Offered by banks or specialized lenders, these loans allow you to borrow money specifically for purchasing solar panels and related equipment, typically with fixed interest rates and repayment terms.

- Power Purchase Agreements (PPAs): Under a PPA, a third-party financier covers the upfront costs of installing solar panels on your property. In exchange, you agree to buy the electricity generated by the panels at a predetermined rate over a set period, often 10 to 25 years.

- Solar leases: Similar to PPAs, solar leases involve leasing solar panels from a third-party provider. Instead of buying electricity, you pay a monthly lease fee to use the panels and may have the option to purchase the system at the end of the lease term.

- Property Assessed Clean Energy (PACE) financing: PACE programs allow property owners to finance solar installations and other energy-efficient upgrades through property tax assessments. Repayments are made as part of the property tax bill over a set term, typically up to 20 years.

- Green Energy loans and programs: Some financial institutions and government agencies offer specialized loans and incentive programs for solar energy projects, providing favorable terms and incentives to encourage the adoption of renewable energy technologies.

Conclusion

Financing solar projects involve thorough research into available options, such as loans, leases, or power purchase agreements. It’s crucial to assess the credibility and experience of solar companies, considering factors like certifications, customer reviews, and project portfolios. They comparing financing terms, equipment quality, and after-sales service, businesses can make informed decisions that align with their budget and sustainability goals. Ultimately, choosing a reputable solar installer and financing option can pave the way for long-term energy savings and environmental benefits.

FAQs

How do I choose a solar panel installer?

Choose a solar panel installer based on experience, certifications, and customer reviews.

Where do solar installers get paid the most?

Solar installers may earn more in regions with high demand and government incentives.

How do I choose a good solar panel company?

Select a reputable solar panel company with certifications, warranties, and positive customer feedback.

What is in solar panels?

Solar panels contain photovoltaic cells that convert sunlight into electricity.

What happens after 25 years of solar panels?

After 25 years, solar panels may still generate electricity but might require maintenance or component replacement for optimal performance.

Haarrii, a seasoned finance expert with 4 years of hands-on experience, brings insightful analysis and expert commentary to our platform. With a keen eye for market trends and a passion for empowering readers, Haarrii delivers actionable insights for financial success.